Profit-center Accounting in S/4HANA (1709 / 1809)

Profit Center Accounting in S/4HANA works based on the GL accounts of the operational COA assigned to your company code. When you create a GL account, you choose an Account type from Balance Sheet Account, Non-operating Expense or Income, Primary Costs or Revenue, Secondary Costs. (Please see Page on S/4HANA GL-Master Changes in S/4HANA)

CONFIG & Master-Data Set-up in S/4HANA*

- Creating Profit-Center

- On the SAP Easy Access screen, Accounting → Financial Accounting → General Ledger → Master Records → Profit Centers →Individual Processing → Create- Transaction KE5

- Or Using Fiori Launchpad – Fiori App “Manage Profit Centers”

- Or Use LTMC – Migration Cockpit Template & migration object “Profit Center” to migrate Profit Center Master data in SAP S/4HANA using a template provided by SAP

- Assign Profit Centers to Account Assignment Objects : Ways to establish a link between Profit Centers and other Account Assignment Objects

- SAP Easy Access – Accounting → Financial Accounting → General Ledger → Master Records → Profit Center →Current Settings

- SPRO→ Financial Accounting, under General Ledger Accounting → Master Data → Profit Center → Assignments of Account Assignment Objects to Profit Centers

Reports – which shows the assignment & DATA-Checks

- 1KE4 – Profit Center Accounting : Assignment Monitor

Use Assignment-Monitor to quick-check the Assignment of ACCOUNT-ASSIGNMENT-OBJECTS and PROFIT-CENTER

- A probable problematic area is Profit Center assignment in Asset Master

Either Profit Center or Segment cannot be stored directly in Asset Master Data, S/4HANA system derives segment and Profit Center from a cost center or an internal order indirectly.

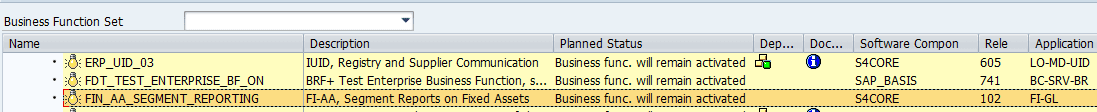

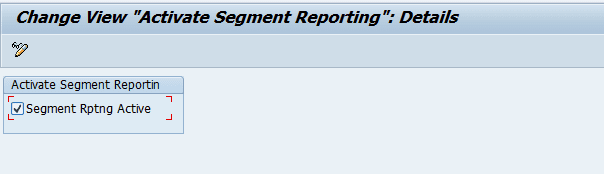

Once you activate below business Function and Activate Segment Reporting option in IMG menu, you will be able to see segment and Profit Center in Asset Master record.

Financial Accounting → Asset Accounting → Integration with General Ledger Accounting →Segment Reporting → Activate Segment Reporting.

- 4th –> Actual Data Flow to Profit Center Accounting

- When we activate the Document splitting process at Profit Center Level, it is easy to identify Accounts payables and Accounts receivables according to their origin at Profit Center level. As Profit Center Accounting is integrated in ACDOCA Table, Businesses do not require to do reconciliations amongst Financial Accounting – Controlling – Center Accounting. Data from logistics flow through assignment of the object to a Profit Center or partner Profit Center.

- As users cannot enter Profit Center information manually for receivables, payables, or automatically generated line items, proper assignments and configuration settings are needed so the system fills the Profit Center field automatically. Sometimes during execution of allocations in Controlling this may result in a change of the Profit Centers. Then it affects P&L of respective Profit Centers.

- When data is posted to financial accounting, users give a Controlling object manually. As we have already established a link between CO object to a Profit Center, data flows to Profit Center. In many FI transactions, users can also enter Profit Center manually.

- Profit Center is taken from material master per purchase order item. This Profit Center is moved to GR (goods receipt) when we do MIGO. This gives “costs of the material consumption” in the relative Profit Centers

- If there is a price difference, this is assigned to the Profit Center of the material purchased. If the price difference account is defined as a cost element, the price difference amount is posted to the Profit Center of the corresponding CO object. Besides, transfer from Financial Accounting, Material management, System transfers from primary and secondary cost postings to Profit Center Accounting.

- If users execute Goods Issue for a Production order, the Profit Center is determined by the finished goods (Material Produced)

- For SD transactions, Profit Center is passed from the sales order to the delivery note, and then to the billing document (VF01) when the goods issued to Customer, change in stock is posted to the Profit Center automatically.

- If account-based CO-PA is active, GL account for changes in stock is to be defined as a cost element. If CO-PA is not active, you must define this GL account as a profit and loss (P&L) account. Profit Center is assigned to each item of the sales order.

- Allocations in Profit Center Accounting

- During Allocations in Profit Center accounting, we use statistical key figures as an allocation base. SAP recommends using Distribution to move from a single Profit Center to multiple Profit Centers as it allocates items to the cost element (the same account remains in the receiver).

- Profit-Center Planning in S/4HANA –? BPC – see blog post

- Transfer-Price in S/4HANA – see blog-post

WHY do I need to activate Profit Center Accounting functionality in SAP S/4 1709?

On recently upgrading an S/4 1610 to S/4 1709 and one of the interesting things that we found was that SAP is recommending that the switch for activating profit center accounting in Controlling should be activated. This was a bit of a surprise because there is no mention of this in the Simplification document for 1709.

Scenario : After upgrade test plant maintenance orders, we start to get errors on cost calculation related to profit center accounting

The 415 message states : “FI-GL (new)” scen. FIN_PCA used in ldgr 0L; activate PrCtr Acctng in COAr 1000 : Message no. FINS_ACDOC_CUST415

Reason :

Diagnosis

The FI-GL (new) scenario FIN_PCA is assigned to ledger 0L in table FINSC_LEDGER_SCEN.

System Response

A consequence of these table entries is that the system regards Profit Center Accounting as active.

The FI-GL (new) scenarios are obsolete: In S/4HANA there is no IMG acitivity available for maintaining scenarios. However, the system still evaluates these obsolete Customizing settings. In order to make it transparent for users that Proft Center Accounting is active, please activate Profit Center Accounting:

Procedure

For controlling area 1000, activate Profit Center Accounting in the fiscal-year dependent settings of the controlling area.

Because the FI-GL (new) scenarios were neither time-dependent nor fiscal year-dependent, please activate Profit Center Accounting for all fiscal years.

Note that activating Profit Center Accounting does not automatically activate the “old” profit center ledger 8A. Activating profit center ledger 8A is not mandatory.

STEP 1 : The first link from the message takes us to 0KE5 where we can activate PCA in the controlling area – ( the check box for PCA activation has been removed from the control indicators in OKKP )

& –> After this change we are able to cost and release the PM order. Now when we make postings we are generating an additional document of Profit-Center Doc . HOWEVER in S/4HANA, ideally this should not be generated as S/4HANA is based on NEW-GL fundamentals.. Further, if we then run old profit center line reports and information system reports ( KE5Z & S_ALR_87013326 Profit Center Group: Plan/Actual/Variance ) it gives output. The Report states ledger 8A and the fields are referencing table GLPCA which also shows ledger 8A , However in New-GL, old profit center ledger 8A was not activated

STEP 2 : The 2nd message-link in PROCEDURE : Activating Profit-Center Ledger 8A is not mendatory – When we follow the link for Activating profit center ledger 8A is not mandatory. This takes us to 1KEF where we need to deactivate the updates to PCA

STEP3 : Also deactivate following error-message

After doing above THREE STEPS, and then when you process the transactions , then no PCA documents will get generated and also no ledger 8A updates will happen, thus old-reports will start to give : No-Data found/No REcord selected message.

WHY IT HAPPENS :

- SAP S/4HANA 1709 Release notes states that –> if you convert to S/4HANA FROM a new GL ECC, you first need to check if ledger 8A is deacrivated.

- Some SAP customers decide to run ledger 8A in parallel after New GL migration. Hence-this check, that you must deactivate it before moving to S//4HANA.

- Customers who are still on Classic PCA and not in new GL should not deactivate before conversion, but should deactivate as a consecutive step

NEW-GL Implementation & PCA

Profit center accounting activation is not required if you are in new GL and using Profit center as document splitting characteristic .

In a new implementation, using New G/L with PCA integrated into the FI-GL. Hence one should not activate the classic PCA component in the first place. You can see SAP Note 826357 .

With the new GL scenarios profit center functionality was incorporated in the GL and the old profit center ledger 8A was not activated. In this case the classic reports in the information system for PCA would not return any results if they were executed

in ECC, OKKP – shows a field for activating Profit-center accounting

Profit-center Accounting : IMP TCODES

- 1KEF : Set Control Parameters for Actual Data in T-Code – check possible inconsistencies in PCA configuration

- OKE5 – Check the Profit-center activation in the current year in control indicators

- OKE4 – EC-PCA: Update settings

- KE52 – Check the activation status

- OKKP : Profitability Analysis is activated or not

You must be logged in to post a comment.